Dr Nathalie Flury & Dr Michael Schröter (HSBC Asset Management): Rethinking healthcare

- Jérome Bloch

- May 20, 2021

- 5 min read

Updated: May 26, 2021

The principal sustainability challenge facing the healthcare sector today is cost. As medical costs continue to grow, a basic social need becomes increasingly inaccessible to much of the population. Thankfully, different approaches are emerging through new treatment options, technology and innovative business models. This can ultimately make healthcare more affordable and help consumers, governments and society alike. The innovation and scale required is also an opportunity for companies and investors. An article by Dr Nathalie Flury & Dr Michael Schröter, Co-heads Sustainable Healthcare, HSBC Asset Management

Addressing Sustainability in Healthcare

Healthcare budget constraints are forcing treatment access restrictions, denying some patients therapies required to treat their diseases with high out-of-pocket payments driving large medical debts. UK patients, for instance, don’t have access to a third of new treatments due to being deemed not cost-effective by the responsible government body (1). Patient outcomes are negatively impacted, as is the industry and investors. This current model is not sustainable.

As we emerge from the pandemic, there will be immense pressure on governments to rein in their spending, of which healthcare plays a large role – one fifth of government spend in G7 countries (2).

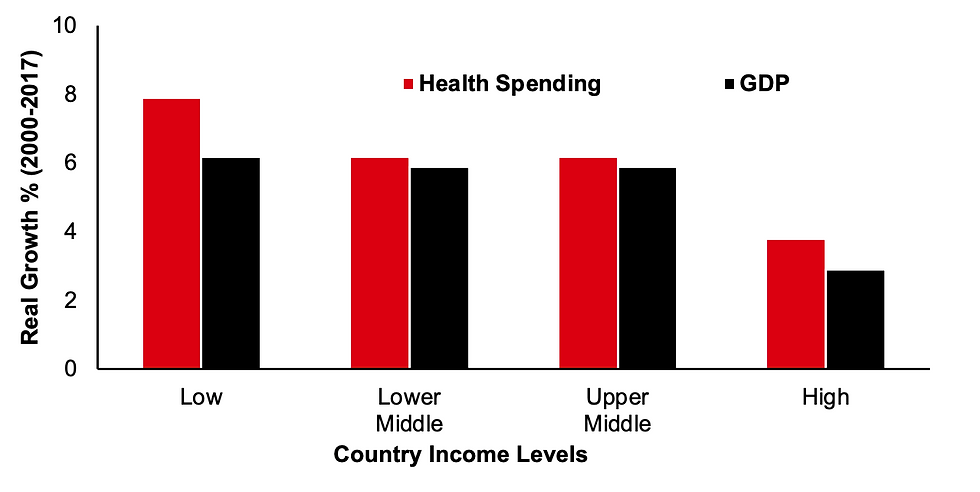

In the US, which accounts for nearly half (42%) of global healthcare expenditure, total spend is projected to increase by over 50% in the next eight years alone (3). The same plight applies globally, with healthcare spending outpacing GDP growth across markets.

This collision of ballooning healthcare costs and strained budgets leaves hard choices for policy makers. Governments must decide what therapies they can afford to subsidise, while insurers, as the healthcare payers, are left to determine treatment access restrictions in order to protect their own profitability. These decisions leave patients unable to benefit from the latest scientific breakthroughs due to barred treatments and high costs.

In developing countries, where governments are less able to subsidise healthcare, even more of the cost burden falls on individuals. Lower incomes mean patients frequently go without treatment due to lacking the means to pay for it. In 2018, average health spending in low income countries per-person was USD40, while in high income countries, it was USD 3,313 - more than 80 times larger (4).

The investment opportunity

For investors, the scope of change needed to stop the cycle of spiralling costs, and deliver sustainable healthcare systems, creates both investment risks and opportunities. Those who are attuned to these stand to benefit and can also contribute to the necessary change. The old pharmaceutical model of simply charging higher prices for therapies based on added clinical benefits must inevitably be rendered obsolete. After all, a product with high profit margins and no supporting sales offers little value.

Companies continually delivering treatments that add costs to the system will be hit hardest by tighter budgets, seeing reimbursements denied, or access substantially limited, ultimately hurting sales and profitability. While this is a known risk today, many pharmaceutical companies continue to operate R&D models that only incorporate late stage accessibility considerations. Likewise, industry analysts largely simplify the risk of market access restrictions in their valuation models.

The resulting profitability projections are unlikely to be achieved, due to a much smaller patient pool than originally envisioned. This is not only hurting patients which are denied access but it will also impact long term company performance and returns for investors. Incorporating these considerations into the investment decision making process provides a more robust understanding of future profitability and the sustainability of business models. Better insights pave the way for superior returns.

With a clear investment opportunity and need for risk mitigation, investors stand to benefit from a proactive approach. While one might assume standard ESG scoring would differentiate between healthcare companies contributing more or less to the unsustainable cost strain, this is not the case. Some companies with “good” ESG scores are the worst offenders in raising drug prices unjustifiably.

Industry-specific analysis and understanding is needed to truly ascertain company impacts on healthcare sustainability. These impacts extend beyond the ability of therapies to treat illnesses at a lower price tag. Healthcare costs need to be addressed holistically.

With nearly 75% of total healthcare costs spent on patient care (5), solutions that can reduce time in care are critically important. Those that can deliver this objective stand to be afforded more pricing autonomy and avoid access restrictions, expanding their market potential. This can be achieved not only through new treatments that better manage or even cure chronic ailments, but also via new technologies in diagnostic tools and medical devices for instance, that are increasing opportunities to deliver care more effectively and efficiently.

A holistic approach to therapies, supported by new tools and technology, can help transition healthcare systems to a more sustainable footing. Investors have a key role to play. In addition to the opportunity to improve returns, they are in a position to reward companies driving more sustainable business models and behaviour, and challenge those which aren’t.

As we have seen with the issue of climate change over recent years, sufficient attention can shift the way of thinking.

[1] - IQVIA 2020: EFPIA Patient W.A.I.T. indicator 2019 Survey

[2] – World Health Organization Global Health Expenditure database

[3] - Bloomberg, Centers for Medicare and Medicaid Services, 2021

[4] – WHO, ‘Global spending on health 2020: weathering the storm’, Link

[5] - OECD Health Data, 2019

Note to investors:

The information contained in this press release does not constitute an offer or solicitation for, or advice that you should enter into, the purchase or sale of any security or fund. Any views expressed are subject to change at any time.

This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe to any investment.

Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way. HSBC Global Asset Management (UK) Limited accepts no liability for any failure to meet such forecast, projection or target. The value of investments and any income from them can go down as well as up and investors may not get back the amount originally invested. Where overseas investments are held the rate of currency exchange may also cause the value of such investments to fluctuate. Investments in emerging markets are by their nature higher risk and potentially more volatile than those inherent in some established markets.

HSBC Asset Management

HSBC Asset Management, the investment management business of the HSBC Group, invests on behalf of HSBC’s worldwide customer base of retail and private clients, intermediaries, corporates and institutions through both segregated accounts and pooled funds. HSBC Asset Management connects HSBC’s clients with investment opportunities around the world through an international network of offices in 25 countries and territories, delivering global capabilities with local market insight. As at 31 March 2021, HSBC Asset Management managed assets totaling US$621bn on behalf of its clients. For more information, see www.assetmanagement.hsbc.com/uk

HSBC Asset Management is the brand name for the asset management business of HSBC Group, which includes the investment activities provided through our local regulated entity, HSBC Global Asset Management (UK) Limited.

The HSBC Group

HSBC Holdings plc

HSBC Holdings plc, the parent company of HSBC, is headquartered in London. HSBC serves customers worldwide from offices in 64 countries and territories in its geographical regions: Europe, Asia, North America, Latin America, and Middle East and North Africa. With assets of $2,959bn at 31 March 2021, HSBC is one of the world’s largest banking and financial services organisations.

Comments